Broadband Snippets

The following information is for reference purposes only. Arizona Broadband for All does not take a position on its accuracy or value to policymakers.

April 2025

- Digital learning lab opens with free Wi-Fi to expand across St. Louis.

- This is the first of four labs.

- The Tandy Recreation Center is equipped to provide residents with computer access, internet connectivity, digital literacy training, and one-on-one assistance.

- These labs are a collaboration between the St. Louis Development Corporation and the City of St. Louis.

- Five key takeaways from successful digital navigator programs:

- Trust is key.

- You will need time, probably more than you think.

- Your digital navigators will need financial and organizational support.

- Measure your digital navigators’ program success in unconventional ways.

- Your digital navigators need ongoing training and community support.

- Eliminating FCC rules in the Delete, Delete, Delete

- To eliminate rules that are antiquated and no longer needed.

- There are several recommendations from ISPs:

- Eliminate broadband labels.

- Get rid of rules that let the public easily opt out of receiving robocalls or texts.

- Eliminate FCC authority to issue fines after the company was recently fined.

- They are expecting lots of lawsuits challenging the FCC for not following the prescribed process for making regulatory changes.

- Kansas, Florida, North Carolina, South Carolina, and Tennessee have classified broadband networks as critical infrastructure, making it a crime to interfere with or damage telecom networks.

- FCC loses the ability to levy fines.

- On April 17, the U.S. Court of Appeals for the Fifth Circuit ruled that the FCC doesn’t have the authority to levy fines.

- The ruling will stand unless the FCC appeals it. We will see!

- One analyst identifies four possible paths for the BEAD rural broadband reform.

- Requiring states to rebid and imposing a federal high-cost threshold that would shift funds from fiber to satellite.

- Requiring states to eliminate certain requirements but allowing the results of the application process to stand with only marginal adjustments.

- Setting some general rules but having the Commerce Department review each state’s awardee lists before approving the release of funds.

- Rewriting the BEAD program rules to award all funding to satellite providers, rerunning the application process, and returning money to the treasury.

- Fiber broadband is probably worry-free from tariffs.

- Fiber broadband operators and their equipment suppliers may not have much to worry about.

- Most common fiber components, such as PON optical line terminals, optical networking terminal cabinets, and fiber optic cables, have already been self-certified by the vendors and have already seen increased domestic manufacturing.

- “There is an important difference between technological neutrality and technological equality. LEO and fiber are not equal, and any policy that treats them as such will widen the very divide we have spent decades trying to bridge.” (Dr. Christopher Ali)

- The biggest issue with LEO satellites is not even speed but capacity. Will the LEO companies be able to provide broadband to the millions of households who will have no other broadband options?

- Ali consensus is that LEO technology barely meets the 2020 definition of broadband that was codified in BEAD and is not a forward-looking technology – it is not equal to fiber or even to fixed wireless.

- A survey found that 63% of Internet users are paying more for their broadband bills from last year, average annual increase of $195 or $16.25 per month.

- Colorado fiber service provider, NextLight, has seen a 14% increase in subscribers of its Internet Assistance Program since APC was terminated. The service provides a $25 discount to qualifying households. These households can choose between a 100 Mbps connection for $14.95 per month or a gigabit connection for $44.95 per month.

- Benton found statistical information to support the connection between ACP and broadband adoption.

- This was the case in both urban and rural areas.

There are no updates this month.

March 2025

There are no updates this month.

- Commission to return the Rural Digital Opportunity Fund (RDOF) broadband funding awarded to providers in the state who later defaulted on their awards. The Missouri Attorney General sent the letter to the Chairman asking for the funds back and to let the state decide how to use them. Rep. Riggs of Missouri helped spearhead the request and the letter. $177 million is currently the default amount.

- Universal Service Fund (USF)

- The FCC recently voted to increase the end-user fee used to fund the USF.

- The 2nd quarter 2025 fee is now calculated at 36.6% of interstate communications.

- Based on Supreme Court rulings, net neutrality is now a state issue.

- Current states with net neutrality laws are California, Colorado, Maine, Oregon, Vermont, and Washington.

- Making it Easier to Kill Copper

- FCC enacted four rule changes to make it easier for telcos to walk away from copper:

- One order allows a telco to turn off copper wires without having to conduct a test to first see if a replacement technology can take over the functions.

- Another order makes it easier for telcos to grandfather copper services.

- Another order provides a two-year moratorium for telcos having to disclose and seek public opinions on changes made to copper networks.

- The final order is a waiver to kill the rule to require telcos to offer standalone voice to replace voice lost when a copper network is torn down.

- Bill introduced by Jerry Moran, KS, to prevent federal broadband deployment from being taxed as income.

- This comes with a heavy price tag.

- It could cost the government $2.5 billion in lost revenue over the first six years.

- FCC enacted four rule changes to make it easier for telcos to walk away from copper:

- Reviews and approvals of the state’s final BEAD plan are still on hold pending review and possible changes to the program and process.

- Broadband stakeholders identified various challenges affecting broadband deployment.

- Statutory timelines to deploy broadband and lengthy permit processes.

- The aggressive timeline for subgrantee selections and technology requirements, and exclusions.

- Nationwide deployment could exacerbate the supply chain and labor market, causing shortages and delays.

- Concerns with NTIA’s communication process – untimely or nonexistent.

- State-by-state BEAD bids reveal varying degrees of ISP participation.

- Arkansas received bids to cover 96% of BEAD-eligible locations, while Massachusetts has received just 5 applications proposing to reach 50% of locations.

- National Rural Electric Cooperative Association (NRECA) urges fixing of Rural Broadband Program

- Recommended that some requirements be replaced, such as rate, wage, and permitting statutes, and removing non-statutory obstacles of the BEAD program.

- BUT retain preference for fiber within the BEAD program.

- AT&T and Verizon continue to aggressively eliminate staff.

- 2024 Verizon cut 5,000 positions. This was in addition to previous cuts, with a total cut during 2024 of 8,910.

- AT&T is more complicated since they acquired several companies, but they, too, have been shedding companies and eliminating staff.

- Both companies are actively striving to eliminate copper networks, with Verizon much further along.

- Speed isn’t everything.

- Most people focus on download speed, but that should not be the only consideration. People need to understand the importance of upload speed.

- Oversubscription – Home connections are served by technologies that share bandwidth across multiple customers. The result can be more neighborhood demand than the bandwidth being supplied can handle.

- Latency – the simple description of latency is the delay in getting the packets to your home for something sent over the internet. If enough packets get backlogged, latency can make it difficult or impossible to maintain a connection. Many users confuse the issue with speed, but it is latency.

There are no updates this month.

There are no updates this month.

February 2025

There are no updates this month.

- New Broadband Laws Moving Through Congress:

- 98 Rural Broadband Protection Act sponsored by Senator Shirley Moore Capito, West Virginia. Requires FCC to vet candidates before awaiting any funding that comes from the Universal Service Plan as a result of an application made to the FCC for funding.

- 278 Kids of Social Media Act sponsored by Senator Brian Schatz, Hawaii. Prohibits social media platforms from allowing access to any kids under thirteen years of age. The law also prohibits the use of personalized recommendation systems for kids. The interesting aspect of the law is that schools have to limit access to social media when using social media.

- It is now being said that fiber broadband is recognized as the fifth necessary utility for 21st century life, on par with water, sewer, electricity, and paved roads that households and businesses need for education, entertainment, health care, commerce, employment, the delivery of essential government services, and so much more.

- What does unlimited mean?

- A source (Pots and Pans) stated that none of the cellular carriers has a truly unlimited cellular data plan.

- Data speeds are restricted once a customer reaches a monthly cap.

- Restrictions on the amount that can be used for tethering during a month.

- Disputes between carriers use the National Appeals Division (NAD) as the arbiter and they have heard disputes on advertising claims.

- NAD’s decision on one company advertising unlimited made a ruling that it was unlimited even with other restrictions since customers never get cut off entirely from using the data.

- The Telecommunications Industry Association (TIA) is pushing to make BEAD grants tax exempt (21% federal levy).

- Congress never intended the BEAD grants to be submitted to federal income tax.

- Treating these funds as taxable income could impede the applicant’s ability to make a substantial impact with the program.

- There seems to be bipartisan and leadership support.

- A source (Pots and Pans) stated that none of the cellular carriers has a truly unlimited cellular data plan.

- PEW report identified four ways to improve and accelerate the broadband expansion network:

- Eliminate unnecessary and constricting mandates that slow the process of expanding services.

- Improve transparency and consistency in decision-making (make public all past waivers issued to states and ensure guidance and decisions are consistently shared and applied across all states).

- Expedite the issuance of any remaining guidance so that states and service providers can work with a full understanding of the standards to which they will be held.

- Leverage NTIA’s leadership role in federal broadband policy to resolve issues that could delay deployment, including data discrepancies and permitting approvals.

- Pauses in the BEAD program could have significant consequences as many states are far into the process.

- Broadband maps:

- Maps were first used to allocate BEAD funding to states, so states that spent a lot of time cleaning up the maps seem to have gotten a better share of BEAD funding.

- BEAD maps even more important during the challenge process but in many states the process didn’t see a lot of vigorous challenges.

- The maps have been terrible since they were first introduced for simple reason that FCC presumes self-reported speeds from ISPs reflect the real speed – they don’t.

- When the BEAD process is completed, it is believed that the FCC will declare the job done, and maps will go away. But there will still be homes without broadband.

- FCC has options to measure coverage:

- Eliminate the ability of ISPs to claim marketing speeds instead of actual speeds.

- Get serious about enforcing coverage claims where ISPs can meet the 10-day installation rule.

- Could compare Ookla or other speed tests against speeds claimed by ISPs.

- Could challenge ISPs where claimed speeds are far higher than speed tests.

- The proposed new NTIA Administrator, Arielle Roth, wants changes to the BEAD program.

- She doesn’t like the fiber preference or low-cost service mandate.

- Extra rules such as climate regulations, union mandates, and wholesale access requirements.

- She wants “tech neutrality” stating Congress never intended to prioritize fiber over other technologies.

- She wants major reforms to the USF and opposes expanding the USF base to include broadband providers.

- Waiting on Roth’s confirmation.

- Any changes would repeat past policy mistakes and waste billions of dollars while delivering subpar internet access to rural families at much higher prices.

- California Public Utility Commission filed comments that said big ISPs don’t focus on customer service because they don’t have to.

- Only 26% of California residents have a choice between two fast ISPs.

- Their study showed that when a community gets real competition between 2 or more ISPs that offer gigabit speed:

- Lower prices – lowers by at least 15%.

- Improved customer service – response to customer outages more quickly.

- Technology upgrades – in a competitive market they tend to upgrade technology a lot sooner.

- BEAD and other federal programs though discourage competitive markets.

- US Telecom represents the biggest telcos and cable companies’ wish list:

- Champion network of the future – make it easier to tear down copper networks.

- Secure and reform universal service – get the system fixed and secure funding for telephone services.

- Put the pedal to the metal on broadband deployment – move quickly with BEAD grants while relaxing some of the BEAD rules.

- Review all legacy regulations – eliminate outdated regulations and reporting.

- Break the federal permitting log jam – this has been on the list for 20 years and causes big delays.

- Model efficient, effective cybersecurity.

- The Brattle Group just published research on the economic benefits of the ACP:

- Overall healthcare savings alone are quadruple the ACPs annual funding and could more than offset the costs of the entire program if it were reinstated.

- A switch from one physical visit to telehealth for one single Medicaid recipient could save enough money to fund 3.5 years of ACP support for one Medicaid recipient.

- Reinstating the ACP would improve students’ academic performance and benefit their future earnings by over $3.7 billion per year.

- $2.1-$4.3 billion in annual wage gains from expanded labor force participation could be generated if the program were reinstated.

There are no updates this month.

January 2025

There are no updates this month.

- FCC Mapping and Engineers

- Broadband Deployment Accuracy and Technological Availability Act created the requirement for a new mapping system that replaced the old system of reporting maps called the 477 process.

- One requirement is that ISPs engage a professional engineer to certify that the data submitted to the FCC is accurate. Resistance is met from ISPs due to additional costs. FCC issued a waiver for this engineering requirement from June 2022 through December 2024 FCC filings.

- If another waiver is not issued, the requirement will go into effect with the filing due for the June 2025 data.

- Something needs to be finalized as FCC cannot continue to issue waivers.

- FCC reduced the requirement in that a company officer can now certify the FCC data as long as they are an engineer.

- Congress clearly intended the requirement for professional engineer signoff. This was intended to ensure the accuracy of the map data.

- We will watch to see what happens to this in the next couple of months.

- Broadband Deployment Accuracy and Technological Availability Act created the requirement for a new mapping system that replaced the old system of reporting maps called the 477 process.

- BEAD Alternate Technology Guidelines – new rules that allowed satellite and unlicensed fixed wireless (originally not eligible).

- Unlicensed fixed wireless (ULFW – new acronym) – originally NTIA stated that the technology does not meet the reliability test described in the legislation.

- Confusing but ULFW still cannot be funded by BEAD. However, by accepting it as an alternative technology it can block another ISP from getting a BEAD grant.

- BEAD can’t be awarded if there is an outstanding grant award to build ULFW and that grant includes a requirement for future proof of speeds (will be rare).

- Before awarding a BEAD grant a state must look at the FCC map to see if a WISP is claiming ULFW speeds of at least 100/20. If they are, the OBD must give the WISP the opportunity to prove it and if so, BEAD will not be awarded.

- LEO Satellite – States can make BEAD grants to LEO satellite providers.

- Must certify it is capable of connecting everybody in a grant area within ten days of a service request.

- The provider has up to 4 years to make this declaration and to start the funding.

- Issue – how does an OBD deal with satellite customers already served in a grant area?

- North Dakota is getting close to their final report and is nearing 100% fiber connectivity.

- ND is a testament to the demand and desirability of deploying fiber as well as the economic feasibility of doing so – even in extremely rural areas with rugged terrain.

- How did they do this – ND has a state infrastructure bank that makes loans to the companies building fiber. The loans have favorable terms for providers.

- They state that subsidies at the federal level were window dressing and took too long to implement, cost too much to implement, and too labor intensive.

- New technology just introduced for deploying fiber networks, Aqualung, pulling fiber through water systems.

- Advantages of this system:

- Case studies show when using the water pipes it reduced the cost of a fiber installation by 50%.

- The claim is that this is faster than traditional construction, speeding up time to market.

- Avoids issues and time to put fiber on poles and getting permits to bury fiber.

- Eliminate damages to other utilities during the burying process and even locate existing underground utilities.

- Eliminates getting drops through yards.

- Claims long-term network safety since fiber is inside heavy water pipes.

- Hurdles:

- Probably be convincing a water utility to allow fiber. Most water companies are municipally owned and conservative and will want iron-clad guarantees that the installation process will not cause damage or leaks to the water system.

- When water systems are replaced on a street, if there is fiber in the pipes, the broadband will be out at the same time.

- Coordination of water utility and broadband provider when either repairs or replacements are needed would be challenging.

- For communities that own both the water system and the broadband network, there would be a better chance of it succeeding and would lower the cost.

- National Lifeline Association annual survey with 68,000 lifeline and former ACP participants responding. Key information obtained:

- 40% reported cutting food spending to afford their monthly internet bills. 36% indicated they discontinued telehealth without the ACP and 64% said they could not maintain regular contact with friends and family without the ACP.

- At least 80% of lifeline/ACP subscribers live at or below the poverty. Nearly one-third are homeless or live in temporary housing. Over half are older Americans. This includes Americans facing unemployment due to a disability (31%) and retirees with limited incomes (12%).

- 78% lack access to a consistent form of internet or mobile data. Without lifeline/ACP benefits 20% accessed the internet through family members’ devices, 27% used public libraries and WI-FI and over 31% had no internet access.

- Advantages of this system:

- New York law requires ISPs to offer broadband rates to low-income households of no more than $15 for 15 MBPS (rumored to change to 100 MBPS soon) or $20 for 200 MBPS.

- The decision was appealed when the 2nd S. Circuit Court of Appeals ruled that federal telecommunications law does not stop states from regulating broadband rates and refused to review the case – the law went into effect.

- Rather than comply with this law, AT&T announced that will withdraw its 5G home internet product in New York and have to offer broadband rates as low as $15.

- It was extraordinary that a large company with $122 billion in revenues last year would walk away from a state.

- Speculation is that this is more like a warning to other states about implementing similar laws.

- Starlink requested an exemption from the law in NY saying they have less than 20,000 customers which would qualify.

- The less than 20,000 customer exemption to be allowed NOT to follow the required $15 plan has led leaders to wonder if ISPs will cap their customer base in NY to less than 20,000.

- Also, of impact, is that Starlink and FWA wireless do not offer different speed tiers. This means a $15 customer gets the same bandwidth as everybody else. Both products deliver all-you-can-eat broadband with no caps on speeds or the amount of broadband used during a month.

- Ask the Question – Should States Consider Adopting their Own Affordable Broadband Law?

- There have been mentions about 22 states (almost half) are most likely to “follow New York’s lead” – California, Connecticut, Delaware, Hawaii, Illinois, Maine, Maryland, Massachusetts, Michigan, Minnesota, Nebraska, Nevada, New Jersey, New Mexico, North Carolina, Oregon, Pennsylvania, Rhode Island, Vermont, Virginia, Washington, Wisconsin, and the District of Columbia.

- New York law gives an exemption to the small ISPs that have less than 20,000. Larger ISPs may have the margin to afford the lower plan. Those ISPs just over the 20,000 limit will be challenged.

- Whether 20,000 is the right number is worth considering in other states.

- NY law was written before the new federal definition of broadband to 100/20. Any additional states considering a similar requirement should consider the definition.

- The law indicates that ISPs in violation can be fined $1,000 per violation, which would result in one violation per day.

- At the time of this article, Massachusetts State Senator Pavel submitted “An Act Preserving Broadband Service for Low-Income Customers” – $15 a month with a minimum of 120 MBPS download. California Assemblymember Boerner introduced a bill mandating ISPs have affordable internet plans.

There are no updates this month.

December 2024

There are no updates this month.

- The FCC Appeals process has been slow.

- Ninth Circuit Count of Appeals recently upheld a June 2020 decision that made it easier for wireless carriers to locate new towers and transmitters (the rule was on hold four years while the courts considered the issues under appeal).

- Having challenges to rules made by the FCC and other regulatory bodies is becoming the new norm as recent Supreme Court rulings make it even easier to challenge orders.

- It is difficult to measure the productivity of FCC as we must wait for a few years to see what actions actually go into effect.

- The U.S. Senate recently passed the ACCESS Rural America Act, a bipartisan bill aimed at helping rural broadband providers reduce regulatory costs.

- Alleviates the regulatory challenges smaller companies face.

- Raised the SEC shareholder registration threshold for entities receiving federal universal service support and mandates certain financial information still be accessible to investors.

- This bill now heads to the House of Representatives.

- The ability of the FCC to issue fines has received attention. Larger carriers are disputing the fines that FCC is levying on them. Basically, this is around the issue of penalizing carriers for selling customer location data to aggregators (the majority of carriers did not get permission of the customers to share their data).

- Carriers (three main carriers) have all filed appeals which has become routine. They are each filing in different appeal courts.

- Sharing customer data came to light when a sheriff in Missouri was openly using a location-finding service to track the people’s location. The sheriff obtained the data from a tele-com provider.

- The argument at the appeals court is that FCC does not have the authority to enforce issues related to consumer data privacy.

- The outcome is unknown. It is possible FCC could drop its opposition to the suits which could stop the legal process.

- For now, the ability for the FCC to impose fines for this situation is hanging in limbo.

- NTIA is seeking input on the proposed BEAD performance measurement guidelines.

- They want to standardize framework:

- Automate reporting.

- Set strong standard for reliability metrics.

- Revise “cross-talk” thresholds and better metrics.

- Provide flexibility to eligible entities.

- Set a strong precedent for future funding programs.

- NTIA is using this measurement platform to ensure that BEAD funding is put to its highest and best use.

- They want to standardize framework:

- NTIA takes additional steps to accelerate BEAD construction.

- They streamlined the BEAD Final Proposal process that will allow states, territories, and service providers to put shovels in the ground more quickly.

- Streamlined more than 40% of questions to save time to focus on implementation.

- Removed duplicative waiting period after state or territory’s review meeting, allowing states to immediately post their proposals for public comment.

- Gives states flexibility to move through the public comment period more quickly.

- States and territories are encouraged to post draft service provider agreements prior to the start of sub-grantee selection so potential sub-grantees can better understand contractual obligations. And they can begin negotiating sub-grantee agreements with provisional sub-grantees immediately upon selection.

- Service providers can complete environmental studies and prepare NEPA documents before NTIA approves their Final Proposal.

- If approved by the state service providers can:

- Order equipment and materials necessary to deploy broadband.

- Negotiation for rights of way and pole attachments can be negotiated and signed.

- Sub-grantees may apply for permits from federal, state, and local agencies and initiate environmental analysis and prepare documentation for NEPA review.

- This is a big push to move from planning to building.

- They streamlined the BEAD Final Proposal process that will allow states, territories, and service providers to put shovels in the ground more quickly.

- Good cellular coverage benefits:

- The Original and still primary benefit is mobility.

- Cellular coverage is the newest utility because everybody expects it.

- In 2023:

- 98% of adults had cellphones.

- Americans connects to the internet just over 7 hours per day.

- In 2023:

- It’s How We Talk – cellphones replaced landlines.

- At the end of 2023, landlines were down to 30% penetration.

- Public safety – the ability to locate a 911 caller on a cellphone was a major breakthrough, and 911 centers can now accept texts.

- In 2023, 80% of all 911 came from a cellphone.

- Payments – money has moved to cellphones for many people:

- In 2023:

- 48% of consumers used a digital wallet.

- 73% use mobile banking.

- 45% of all payments to another person was made using mobile device.

- 27% of all bills were paid using a mobile device.

- In 2023:

- Health monitoring – millions of people monitor sugar levels, blood pressure and sleep issues with cellphones and it is routine to send people home from surgery with devices and an app to monitor vital signs.

- Back up for home broadband – any time there is a hitch or outage in connection at home, the cellphone is used as a substitute.

- Back up for communities during and after disasters – cellphones often becomes the only broadband.

- For some, it is the only form of connectivity.

- Some communities have between 5% and 10% of adults with no access to landline broadband at home or office

- Fewer dropped calls or service interruptions – good cellular coverage means higher quality of connection.

- Better battery life.

- Businesses/landlords want better coverage – impacts their success.

- Employees expect it -impacts retaining employees.

- Apps have revolutionized the economy – requires good coverage

- Entertainment – a huge percentage of entertainment is consumed on cellphones.

There are no updates this month.

- Grant Funding for Government-Owned Networks

- New York recently awarded $140 million in grants to support publicly-owned open-access networks.

- Funds are from the Capital Projects Fund.

- The projects constructed 1,200 miles of fiber and wireless assets to over 60,000 locations.

- Stated as public-private partnerships because the local governments will own the infrastructure and ISPs will provide service to the customers

- While BEAD eligible, broadband infrastructure grants to local governments are rare. Reasons include:

- Timelines are typically short for the local government to do all their homework,

- Local governments usually use bond funding to pay for matching requirements which can also be slow.

- Grant scoring rules generally and heavily reward past performance as an ISP; hard for startup to get grant funding, not just a municipal startup. New York dedicated funding to make this work.

- FCC adopts order that eases Letter of Credit (LOC) Requirements – provides:

- Changes requirement that a U.S. bank issuing a LOC to have a Weiss bank safety rating of B- or better, and instead requires the bank to be “well capitalized” according to definitions by the federal agencies that supervise banks.

- Allows RDOF support recipients that have deployed service to at east 10% (rather than 20%) of their required locations by the end of their second year of support to, upon verification, reduce the value of the LOC to one year of support, rather than requiring an annual increase to 30%.

- Makes permanent a bureau-level waiver adopted in 2020 and extended annually since, allowing auction 903 recipients that have met each of their deployment and reporting obligations to follow the LOC rules for auction 904.

- Extends waivers, until the Order changes take effect, to allow CAF II recipients that have met obligations to follow the RDOF LOC rules and,

- CAF II and RDOF recipients to maintain their LOCs with banks that previously held Weiss bank safety ratings of B- or better but subsequently fell below B-.

November 2024

- Benton Institute issued a press release, “NTIA Should Stay the Course Toward Digital Equity.”

- The release states that “it is the law” and NTIA is merely following the law as Congress intended.

- This is a law worth pursuing!

- The issues being stated concern “minorities” being a covered population; but that is how the law was written. Minorities are one of nine covered populations spelled out in the law.

- Hopefully, NTIA will get the over 700 applications reviewed, the awards made, and the money out the door.

- A major policy issue is that nearly a third of the states (16 states) have preemption laws in place that either prevent or restrict local municipalities from building and operating publicly-owned, and locally controlled.

- Statistics show that wherever municipal broadband networks or other forms of community-owned networks operate, the service they deliver residents and businesses almost always offers faster connection speeds, more reliable service, and lower prices.

- The BEAD program requires that municipalities be eligible for receipt of funds. This is not being monitored or enforced so some states are not following the intent of the law.

- Four states that had preemption laws changed after covid. Arkansas, Washington, Colorado and Minnesota have significantly rolled back legislative barriers on publicly-owned broadband networks.

- Sixteen states still have preemption laws limiting community networks – Alabama, Florida, Louisiana, Michigan, Missouri, Montana, Nebraska, Nevada, North Carolina, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, Wisconsin.

- One Resource’s opinion of what survives from the current FCC Chairman’s FCC:

- There are a few items that most believe will be reversed. The first is net neutrality (possibly kill Title II regulation). The second would be a reversal on discrimination (probably will be softened).

- Possible policies that will be reviewed:

- 5G Plan for Rural American

- Reexamine overall role of the Universal Service Fund (USF)

- Penalties for FCC Mapping – in August FCC threatened significant fines for eleven ISPs that failed to participate in the data collection and mapping process. All 11 have missed 3 biannual filings to the FCC and have been issued warnings.

-

- Could result in a fine not to exceed $24,496 per day or maximum fine of $183,718

- An additional fine was issued to a provider in Illinois for making false claims about providing fiber service that did not exist. This company admitted that it made the false filing to prevent another ISP from winning grant funding for the area.

- We are not seeing fines for misstated speeds as the map rules allow ISPs to claim marketing speeds rather than some approximation of actual speeds.

-

- We have been talking about poles for decades. Regulations on the process of attaching to poles is complicated and challenging to change. Every pole is a unique case and must be treated individually.

- Following are a wide variety of situations that exist:

- There are any wooden poles, but also some metal poles.

- Poles are varying ages, some look brand new and some look like they are ready to fall down.

- Poles are different heights (tall poles have more space for new wires).

- There are varying numbers of existing wires connected.

- Poles at intersections are more complex with wires coming from multiple directions.

- A few poles have things hanging on them other than wires (small cell systems, public safety cameras, or devices hung by the electric utility)

- You can see a maze of drop wires connecting electric, telephone, cable and fiber wires to nearby buildings.

- You can see existing wires that are not hung properly.

- An ISP that wants to hang fiber along a street or road cannot do so until every pole has been made ready and average has indicated that every third, fourth or fifth pole will have an issue.

- First step is assessment of which poles need to be replaced or amended which takes time, both for the assessment and then the actual work of addressing the poles.

- This will remain a topic of discussion as BEAD funds are awarded and construction begins.

- Following are a wide variety of situations that exist:

- Ajit Pai, the former FCC Chief during Trump’s first term, recently did an interview and based on his experience made several comments about the BEAD program:

- He expressed concern that the law was passed over three years ago and not a single location has been connected. He feels the primary issues with the program appear to be process related (regulatory red tape).

- He predicts that there will be changes that will include removing some of the “regulatory burdens” to get the money flowing as quickly as possible.

- He believes that alternative technologies should be a part of the equation to be efficient with taxpayer dollars.

- Of specific interest, when asked about the future of the FCC, he stated that the agency is less and less relevant with the NTIA taking on many of its roles.

- Louisiana is the first state to submit their Final Proposal to NTIA for approval.

- More than 95% of the 140,000 BEAD eligible locations are scheduled to get fiber from the awards.

- The balance of the locations are going to satellite and fixed wireless.

- About 70% of the BEAD dollars are being awarded to ISPs based in the State.

- Over half of the awards went to a consortium of local ISP’s.

- National Rural Electric Cooperative Association (NRECA) made a filing with the FCC that warned that the current FCC maps do not reflect the reality for broadband.

- Concerned there will be a lot of places that need broadband that will not be covered by BEAD.

- Problem is ISP self-reporting broadband speeds and are allowed to report marketing speeds rather than actual speeds to customers.

- This is different from FCC requirement of reporting speeds under the new labeling process.

- NRECA suggested that the public should be allowed to take speed tests to report to FCC and FCC has the ability to do this since it does so for cellular broadband.

- ISPs are not in favor of the public submitting speed tests as they can be skewed as well.

- Most believe that the NRECA is correct that there will be a lot of rural areas that will be excluded from BEAD because of overstated broadband speeds. While the BEAD map challenge process was to address this issue, that did not happen for various reasons. It was a complex process and local governments don’t’ have the resources or budgets to take on a challenge process.

- The BEAD process requires every state to certify that all unserved areas were served with the funds. It does not take into consideration this issue of speed overreporting or previous funding that continues to default.

- One of the newest uses of broadband discovered during the pandemic was veterinary telemedicine visits. The numbers of telemedicine visits have exploded.

- Some states have laws for veterinarians that do not allow them to dispense medicine over the phone or telemedicine connection for a pet they have not previously seen. However, many vets are able to prescribe medicine for a pet they have recently seen, and some states are more open to allowing vets to prescribe medicines during an online visit.

- This area could grow in the future saving time and money.

- There are more low-orbit satellites entering the market.

- A high number of these are Chinese satellite ventures. Russia is also putting satellites in orbit.

- Russia, through OneWeb currently has 660 satellites in orbit and is offering services to governments and selling excess broadband capacity to residential satellite providers like Hughesnet, Viasat, and Starlink.

- The broadband industry is suddenly awash with talks of acquisitions and mergers – Merger Mania!

- In September Verizon announced acquisition of Frontier Communications.

- T-Mobile announced two acquisitions, Lumos and Metronet, both fiber builders.

- T-Mobile is also buying Uscellular.

- Bell Canada wants to buy Ziply (used to be with Frontier)

- DirecTV announced it will acquire the video assets of EchoStar (recently merger with Dish).

- A recent article by Fierce Network said that 400 fiber ISPs are ripe for acquisition.

- Interesting trend to watch!

- Broadband from the Past

- 25 years ago the predominant form of broadband was dial-up and we were seeing the first DSL and cable modem trials in the market

- 10 years ago the big difference is broadband speeds.

- Average speed in the U.S. was 18.2 Mbps

- FCC adopted the updated definition of broadband of 25/3 Mbps, up from 4/1 Mbps.

- In 2014, the broadband penetration rate was around 80% of households, up from 20% of homes ten years earlier.

- Video-streaming was becoming a big deal and Netflix already had 48 million customers.

- Video-conferencing platform was being used but mainly for business meetings.

- Apple sold 40% of cellphones and Samsung had a 21% market share. Blackberry still held a 5% market share.

- The bottom line from this look back is a recognition of the strides we’ve made with broadband speeds in the last 10 years and they continue to increase.

- Broadband Usage 3rd Quarter 2024 (published by OpenVault)

- Average monthly broadband usage per customer in gigabytes.

- Over the last 4 years the average monthly download and upload usage has increased roughly 53%.

- This means continued pressure on broadband networks.

- There is a group called “power users” who are customers that use more than 1 terabyte of data per month and those using more than 2 terabytes. This category shows the potential hard created when ISPs place data caps on monthly usage (3rd quarter showed 18.6% for 1 terabyte and 3.6% for 2 terabyte both continuing to increase).

- The report shows that the average rural customer uses only slightly less average broadband than urban households.

- The report includes a section that shows there is no longer a strong correlation between household incomes and data consumption as has been seen in the past.

There are no updates this month.

There are no updates this month.

October 2024

There are no updates this month.

- The FCC announced it is ready to launch its 5G Fund which will provide $9 billion to bring better cellular coverage to rural America.

- Areas that are eligible for the 5G Fund will be chosen using mapping data collected from cellular carriers of where they claim to serve.

- An area is considered served for this purpose if at least one carrier is providing 5G cellular coverage with a speed of at least 7/1 MBPS.

- Unlike broadband that measures speed in a specific location, cellular coverage is mobile. The speed may meet the speed requirement at their home but they also care about coverage when they are commuting, shopping, going to school, etc.

- This creates a dilemma when the reality is that delivery drivers, real estate agents, commuters and anybody else who regularly moves between the city and rural areas must subscribe to multiple carriers to guarantee a working cellular signal.

- Roaming fees and caps become the issues in many situations.

- 5G will bring cellular service to areas where no carriers serve, which is good. But it will not resolve the issue described above.

- FCC is Investigating Data Caps

- Back in June, FCC stated they were going to investigate the impact of data caps imposed by ISPs on broadband usage (an arbitrary cap on the amount of home broadband usage in a given month).

- Most ISPs don’t use data caps and most home broadband usage is unlimited but there are still ISPs that enforce data caps.

- Some larger ISPs have data caps and numerous small ones – Comcast, Cox, Mediacom, Sparklight, and practically all cellphone plans have a data cap.

- FCC set up a portal to gather user data. Universally consumers hate data caps, mainly due to the severe penalty assessed if a household uses more data than the cap allows.

- The investigation is interesting for many reasons and the results are not surprising. However, the FCC does not currently have the authority to do anything about data caps. This authority is being looked at by the courts.

- Broadband Labels Are Here

- On October 10 all ISPs in the country were supposed to implement and post broadband labels.

- The purpose of the labels is to let prospective customers comparison shop, and the labels must be posted on the website for anybody to find.

- FCC implies that they will fine ISPs that do not create labels or who create labels that do not comply with the rules.

- There is a difference between what ISPs must report to FCC on the map requirements versus what they must display on the labels. For instance, FCC allows ISPs to report “marketing speeds” for the map requirements but the labels require them to list an approximation of “typical” broadband speeds that is based on internal and documented network testing.

- There is considerable information required to be on the label and there is a process where a consumer can file a complaint if not met.

- Labels can be a great marketing tool for ISPs that advertise honest speeds at a good price.

- Click to Cancel is Coming (FCC Requirement)

- FCC adopted new rules with the Click to Cancel order.

- The rules require companies to make it easier for customers to cancel services.

- 180 days published in the Federal Register and should be effective sometime in April, 2025.

- This will affect any ISP or cable company that allows customers to sign up for new services online.

- Two major aspects of new rules:

- Companies that sell online have to be truthful and clear with customers about what they are buying and

- The process for cancelling service has to be as easy as it was to buy service. This means no multiple screens to cancel – just one click to cancel.

- Companies will be given six months to develop and implement their online cancellation.

- A key aspect of the BEAD program is the process through which broadband offices reimburse grant recipients for their expenditures.

- Most ISPs would like a process that would allow monthly reimbursement based on invoices of real expenditures that are submitted to the grant office.

- This is a labor-intensive process for a broadband office and other options are being considered.

- Each state will determine this process.

- The Center for Rural Innovation (CORI) released a research report “Beyond Connectivity: The Role of Broadband in Rural Economic Growth and Resilience” showing remarkable findings of fiber broadband experiences in rural communities boosting income, entrepreneurship, and business investment. Rural counties with high broadband adoption rates of over 80% have:

- 213% higher business growth rates

- 10% higher self-employment growth rates

- 44% higher GDP growth rates

- 18% higher per capita income growth rates

- Speed Tests

- Anybody who looks closely at speed test results will understand that any given speed test might not be accurate because of issues inside a home.

- A home might receive adequate broadband but an old or underperforming WiFi router might lower the speed delivered to the devices.

- WiFi is also subject to distance and interference issues.

- Computers located at the far end of a house might receive significantly slower speeds.

- However, when taken in mass, speed tests provide an accurate comparison.

- American Association for Public Broadband (AAPB) has launched a mentorship program that will pair communities interested in building publicly-owned, locally controlled broadband networks with cities and towns that have already successfully done so.

- Local officials get help to navigate the logistical, technical, financial and political challenges associated with building and operating municipal networks.

- “How to Build a Public Broadband Network” is a guide for local officials, offering analysis, practical advice and lessons learned on everything from feasibility studies, business models, financing, marketing, as well as case studies.

- There are currently more than 400 municipal networks servicing over 700 communities in 33 different states across the nation.

- AAPB offers the mentorship program to any interested city or town with no obligation to become an AAPB member.

- The link for the program is on the AAPB website.

- PEW Charitable Trust analyzed all state plans related to the Digital Equity Act (DEA). PEW found that every state and territory says that the primary barrier to closing the digital divide is affordability. With the expiration and end of the Affordable Connectivity Plan (ACP), the states are struggling with affordability issues. In PEWS analysis they identified some alternative solutions communities are trying:

- Expand free WiFi at community anchor institutions to provide more places for the public to connect to the internet

- Bring free broadband to public housing

- Bring free WiFi to parks and other commonly used outdoor locations

- Establish tech hubs where people can not only get free WiFi but can use public computers and get trained on how to use computers and broadband

- Lending programs to get internet-connected devices to the public

- Establish telemedicine hubs

- Fund WiFi infrastructure for newly constructed low-income housing

These are all great ideas but not nearly as beneficial as getting broadband directly into every home. “The gap in digital skills between students with no home access or cell phone only and those with fast or slow home internet access is equivalent to the gap in digital skills between 8th and 12th grade students.”

There are no updates this month.

September 2024

There are no updates this month

- First “Buy America” BEAD certification for fiber closure and pole line hardware

- PLP Company with headquarter in Cleveland OH, announced it had attained the first “Build America, Buy America (BABA) Act certification for supplies and devices that can be used for broadband infrastructure projects funded by the BEAD grants.

- Compliance with these requirements ensures that projects funded by the BEAD program will use materials produced domestically, supporting American manufacturing and job creation.

- They have a long list of products now certified for BEAD under BABA and will continue to certify more products.

- Universal Service Fund

- Biggest controversy is how USF is funded, which is mostly on the backs of telephone and cellular customers.

- Fifth Circuit in New Orleans ruled the structure unconstitutional. Supreme Court has it now. If that case holds up, the entire fund could be ended and would force Congress to redefine the rules to keep the fund operating.

- Several programs are funded by USF – E-Rate Program, Rural Health Care Program, Lifeline Program, High-Cost Program.

- We will see how the Supreme Court rules.

- Concerns with the 5G Fund

- New 5G fund will provide $9 billion to improve rural cellular coverage

- Concerns:

- FCC cellular maps are highly inaccurate. One reporting weakness is that cellular reporting only looks at cellular coverage at the homes. Cellular coverage should be measured along the roads where people drive every day as well – data is incomplete.

- There is no public map challenge – FCC does not give citizens and governments a change to challenge the information. But, just like in the BEAD process, the challenge process is difficult and almost impossible to challenge based on the intense rules. Speed tests can only use FCC app, multiple tests are required, only outdoor tests matter for the 5G fund, if carrier has overstated coverage areas and claim as covered then nobody is going to have a phone subscribed to a non-working service, etc.

- Poor rural cellular coverage is a huge issue and if FCC does not change requirements and processes for the 5G fund, communities will get missed and be stuck with poor cellular coverage.

- BEAD and the Political Calendar – there are potential delays on the horizon due to political calendar

- Presidential Election in November and either way the administration will change

- People in cabinets will change so the trickle-down effect kicks in

- BEAD awards cannot occur until the state submits a detailed report to NTIA about the grant process and that all unserved are served. This will not occur for the majority until after the transition.

- With all the leadership and staff changes expected plus the fact that no awards from BEAD have been made yet, most expect further delays and changes from the administration change.

- BEAD Under Pressure

- The 3-year anniversary of the Infrastructure Investment and Jobs Act (OLJA) is on us

- Designed to provide broadband to all but after 3 years no awards have been made

- NTIA posts that there are no delays and that they are on schedule as they saw this program as a 10-year timeline to get finished

- Other federally funded programs (Capital Projects Fund and CARES funding) have had much quicker results

- Difference between these previous programs and BEAD is the extensive congressional requirements and NTIA requirements placed on the program. Too many hoops to jump through.

- Most blame NTIA for the delays and micromanaging but congress owns a lot of the responsibility for the program’s challenges.

- Unnecessary hoops that states are asked to jump through that are holding up successful program implementation:

- Single largest holdup is the curing process. There are multiple levels of approval during this process which is why Initial Proposals submitted by states are still not approved nine months plus later. One of the bottlenecks is during the legal review – not enough attorneys and when legal finds something the process starts all over again.

- Second largest holdup is the “unclear approval processes”. NTIA is building the processes for the BEAD program as they execute it. States moving quickly through the process end up waiting for NTIA to decide what the next step processes will be.

- Policy disagreements (politics) – cost, low-cost dispute, etc.

- Solutions Proposed:

- Trust the states – BEAD was to be a state-driven program but it is not. States are required to obtain approval on every step.

- Progress should trump process – states that move quickly should not be penalized by having to wait for processes that are not developed yet.

- Let go of policies that lack clear congressional intent – if a requirement is not in ILJA, NTIA should not require it. Don’t lose sight of the grant mission.

- Change the Law – congress can always change the BEAD requirements if they are too cumbersome to execute.

- Community Network – Increase in community-owned networks – those that owned and operated their own broadband networks

- 2011 there were 130 networks covering that many communities on the Community Network Map

- 2024 that number grew to more than 400 networks covering more than 700 communities on the Community Network Map

- One-third of these networks provide high-speed internet access to nearly every address in the communities where they are located.

- 16 states still restrict or ban cities from building and operating their own telecommunications infrastructure (Alabama, Florida, Louisiana, Minnesota, Missouri, Michigan, Nebraska, Nevada, North Carolina, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, Wisconsin)

- Municipal networks are often rural, mostly small. The average community served is 16,000 people.

There are no updates this month.

- Researchers find ISPs overreported service to rural areas after receiving Connect American Funds (CAF) – study from UC Santa Barbara

- FCC established CAF in 2011 – $4.5 Billion in federal funding for broadband infrastructure

- Now, 13 year later, after analyzing 537,000 addresses in 15 states, researchers found only 55% of addresses that were to have service from CAF actually had service.

- Worse, just 33% of these locations met the minimum speed requirements set by FCC.

- MISSING – better oversight and accountability and transparency.

August 2024

- The Fifth Circuit Court granted the FCC’s request for a stay of the court’s mandate on the USF (saying it is unconstitutional). This means the E-rate and RHC programs will continue to operate as normal for now. This is probably headed to the Supreme Court.

- Next Generation 911 (NG911) – On July 9 the FCC ordered all carriers and local governments to complete this transition. In technical terms this moves 911 off the traditional public switched telephone network (PSTN) to an IP architecture. This is causing extra cost since local governments are having to support both the old and new protocols until complete transition. Without getting into technical details, the FCC ordered the transition in two phases. The new process will:

- Eliminate carrying the 911 calls out of state (which made no sense)

- Reduce the risk of 911 outages

- Reduce costs in some areas

National cellular carriers, text providers, and wireline providers other than rural incumbent local exchange carriers (RLECs) will have six months to implement a valid request from s State 911 Authority. Small telcos, non-nationwide CMRS providers, and Internet-based TRS providers will have one year to implement a valid request to change.

Missouri is working hard on this transition and over half the counties have received grant funds for the cost.

- New York State’s Affordable Broadband Law – New York has a law mandating affordable broadband prices for low-income consumers. This law requires monthly broadband prices of $20 or less for eligible subscribers. This has been met with much resistance.

- The law was upheld by the Second Circuit Court.

- ISPs requested that the U.S. Supreme Court strike down this law.

- New York Attorney General temporarily halted enforcement of the law while the Supreme Court considers the appeal.

The legal battle reflects ongoing tensions between state and federal authorities over the regulation of broadband services.

- Click-to-Cancel Initiative – FCC has proposed rule that would require companies to make it as easy to cancel service as it is to subscribe as part of their consumer-friendly initiatives. A couple other initiatives are:

- Requirement that would provide customers with the ability to talk to a human by pressing a single button. Some companies only provide customer service using AI chatbots and this would also eliminate having to wade through a maze of bot questions to get to talk to somebody.

- Executive order to eliminate junk fees, which are hidden fees for services that are not known to customers.

- Is There a Technician Shortage – a recent study, Broadband Markets Workforce Needs, predicts the industry is going to be short of the fiber construction workers, fiber technicians, and engineers needed to meet the upcoming broadband deployment. They also predict there will be 199,200 fiber construction workers and technicians retiring over the next decade to replace.

- Must find a way to fill these positions or there will be significant BEAD construction bottlenecks and delays.

- Currently, construction contractors are saying they are not having problems finding workers so cannot justify putting effort and cost into hiring and training.

- Still lots of projects occurring now and awards of other programs in near future, plus the continued expansion of the big telcos, cable companies and fiber overbuilders will increase the demand for more labor workers.

- Labor shortage will result in fiber construction projects to fall behind schedule.

Providers are thinking about this this and will probably have to address it in the future.

- MISSOURI and ARIZONA BEAD Proposal Approved -Missouri and Arizona were among eight states to get Initial Proposal Approved. This means these states can now draw down the full amount of their NTIA BEAD funding allocation and begin process of administering them to subgrantee award recipients. This sounds good but it also means the 1-year time clock is ticking.

- Bottlenecks in the BEAD process is expected but maybe not in the areas most people expect. T is not expected that most of these delays will be crippling like during covid and they may not impact all projects (more regional). But delays will slow construction at times and that can mean extra cost for anybody building a network. Some areas that could be impacted:

- Engineering and Design – a lot of miles of fiber to design in 2025-2026 that could easily result in a 50% increase in demand for the folks who design networks.

- Environmental Studies – Many BEAD studies will require environmental studies. This is something that is not done for most other fiber construction. Expect 2025-2026 in early process stages.

- Locators – Expect more aerial than buried fiber built with BEAD, but there will still be a substantial need for buried locators. Expect this more in the rural counties that don’t have the resources available to handle big increase in workload.

- Pole Make-Ready – One of biggest bottleneck expectations will be from pole-owners that get swamped with huge numbers of requests to get onto poles. There are regulatory rules that say the process has to be speedy but that’ not going to matter when the pole owner can’t handle the volume.

- Permitting and Rights-of-Way – local governments will be asked to issue a huge number of permits for construction. This will be the same as locators in rural areas, not enough resources/staff. ISPs currently building in rural counties are already hitting these delays.

- Fiber Contractors – It is believed that all BEAD projects will find a construction contractor. The delays will come from contractors trying to keep technicians. The Powers and Communications Contractors Association recently indicated there is a current shortage of 28,000 experienced construction technicians. This can only get worse.

- Fiber Materials – Providers will be wanting to buy materials within a relatively short time window. Add to this, manufacturers trying to supply everybody with BABA -compliant hardware.

- NTIA issued Alternative Broadband Technology Guidance says:

- The extremely high cost per location threshold is a subsidy cost per location, established by eligible entities that may decline to select a proposal for reliable broadband service if use of an alternative technology meeting the BEAD program’s technical requirements would be less expensive. NTIS t issue additional guidance regarding the use of alternative technologies to serve unserved and underserved locations.

- As a starting point, regardless of the technology used, the Bipartisan Infrastructure Law requires internet service providers to deliver speeds of 100/20 MBPS and latency of less than or equal to 100 milliseconds.

- States must use “reliable broadband” technologies first. This is internet service that meets high-speed thresholds, can adapt to changing societal needs, and provide service for decades.

- Fiber builds are priority projects for BEAD.

- Next priority is other “reliable broadband technologies” like coaxial cable or licensed fixed wireless.

- In limited circumstances, states can choose to fund projects using unlicensed fixed wireless and low-earth orbit satellite broadband service (must meet speed and latency requirements).

- Is 5G faster than 4G?

- Ookla recently surveyed and compared the time it takes to load pages for Facebook, Google, and YouTube on cellphones for both networks. The time needed to load a web page is directly impacted by latency which measures the lag between the time a phone requests a website and website responds.

- Results showed:

- 5G improved page load times by 21% to 26% for the above three popular websites (26% for Facebook, 22% for YouTube and 21% for Google)

- This is overall result and does not mean that 4G is not faster is some areas and neighborhoods.

- NOTE – measuring page load time is not the same as measuring speed on a speed test.

FINAL SUMMARY – the long list of big improvements that were promised by 5G never materialized. That being said, these national statistics will vary by market. It is also likely that the performance of these two technologies differs during the day as the load on the networks ebbs and flows. But the Ookla statistics show that, overall, there is better performance on 5G

There are no updates this month.

- Broadband Fairness Act – in August, Senator Josh Hawley from MO filed this legislation. The Act is simple and would return any defaulted grant funds administered by a federal agency back to the State where the award was originally intended. The Act encourages the states to use the money directly for the areas that were affected by the default if still unserved.

- Can be complicated. Consider that RDOF is paid over ten years. Would need to consider if this means states would get those funds over 10 years and how states will develop a process for use.

- Would apply to RDOF, ReConnect, CPF, SLFRF, EA-CAM, NTIA CAF-II and BEAD (with a grant program of this size there will be defaults).

This Act is a way to get defaulted money back into action much faster than waiting for federal agencies to launch a replacement grant program. It is expected that this legislation will take bi-partisan support and sponsorship to get traction but what a great idea!

July 2024

- NTIA has been slow in launching the 2 DE grant programs.

- Law was enacted in November, 2021 and grants were intended to start being issued in 2022. It is now 2024.

- Competitive grant program had short application window.

- Grants must be spent within four years of date of grant award with one additional year to “measure and support” the grant funded activities.

- NTIA WARNS THAT NO GRANT EXTENSIONS WILL BE ALLOWED.

- FCC updates speedtest app for IPhone, Android

- FCC rolled out new mobile speed test app to allow users to test their broadband speeds and SEND THE DATA BACK TO THE AGENCY.

- Effort to collect more accurate data and this data can be used to challenge the coverage data reported by providers

- New version of the app in on the FCC website for downloading.

- One of the biggest challenges for BEAD grant is for State Broadband Offices to make sure that every unserved location gets covered by the grants.

- NTIA will not approve the BEAD grants being made by the State until they can demonstrate that every unserved and underserved location will be covered by the grants.

- The problem States will encounter is finding a solution for the many small pockets of unserved customers. Finding an ISP to build to these many small areas will be a challenge.

- In the majority of states, the number one criteria for awarding grant points is by having the lowest construction cost per passing. This typically is achieved by an ISP having a network that only goes to larger pockets of unserved customers. The cost per passing climbs dramatically if network is to reach scattered smaller pockets.

- To make matters worse for an ISP, BEAD rules frown on funding any middle-mile fiber that might be needed to reach the remote pockets.

- Dilemma does not apply just to fiber ISPs. Wireless networks don’t reach everywhere because of dead spots created by hills and terrain. A wireless ISP will often have to build extra towers and backhaul to reach every location in these disjointed BEAD areas.

- The author of this article predicts that ISPs will refuse to take on impossible service areas and this will add months to the grant process and potential negotiations.

- Low-Cost Service Requirements

- Several industry groups and associations have urged NTIA to relax the low-cost service requirements for the BEAD program. No action to date.

- Request state the $30 low-cost requirement is unrealistic and could hinder the program’s success in high-cost, hard-to-reach areas.

- ISPs providing service in rural areas where they can average 1-5/6 homes per square mile that are having to offer a $30 plan is below their operating costs and just not reasonable. They are unable to provide these households will the same level of installation, service and support as homes paying the standard rate.

- Compliance with Buy America Requirement

- NTIA released a narrow and targeted Bild American, Buy America (BABA) waiver for the BEAD program.

- Waiver requires certain equipment be produced in US while waiving domestic manufacturing requirement for other equipment.

- Still results in the majority of fiber equipment and electronics being made in the United States.

- Entities to self-certify and report compliance with the BABA requirements and use of the waiver.

- This is complicated and should be reviewed carefully on the NTIA website.

- NTIA considers the BEAD program not just a connectivity program, but also a jobs program which is part of the reason for these requirements.

- NTIA released a narrow and targeted Bild American, Buy America (BABA) waiver for the BEAD program.

There are no updates this month.

There are no updates this month.

- RDOF Defaults

- FCC authorized 379 companies to receive $6 billion in RDOF support over a 10-year period, covering just under 3.5 million locations in 48 states and 1 territory.

- As of July 10, 2024, only 16 out of 379 recipients have defaulted (FCC has not published a list showing the relevant number of locations associated with defaulted census blocks, nor can we find any outside party that has undertaken an attempt to figure this out.

- Defaulting companies are not volunteering those numbers and its difficult to mash up the FCC spreadsheet of defaulted census blocks with the other spreadsheets released before the auction.

- As a result, the general public doesn’t know how big or small the problem is.

- Even recent defaults and partial defaults do not mention the actual number of defaulted areas or the amounts.

- February, 2024 a coalition of 69 ISPs and others, filed a letter with FCC seeking amnesty for companies that default on their RDOF or CAF deployment obligations. The FCC found no demonstrated need for broad relief and no changes were needed.

- Based this decision on fact that only 4% of CAF II recipients were reporting not timely meeting their buildout milestones and 71% of RDOF carriers had reported locations as served a full year prior to the first deployment milestones.

- This does mean that 29% of RDOF carriers have not reported any deployment a year ahead of their milestones.

- FCC currently reaching out to RDOF companies to get updated status of their projects.

- Examples of responses from 8 companies did not indicate to FCC there would be a problem in completing their requirements.

- Mandatory milestones for RDOF do not occur until the end of 2024 and in many cases 2025.

- Most RDOF winners to have 40% of their RDOF committed areas in each state by end of this year.

- Failure to meet these commitments could result in reduction or end of subsidy payments and even FCC tapping into the funds guaranteed by letters of credit.

- FCC standing firm and expects carriers to fulfill RDOF obligations.

June 2024

- Here are the three publicly available resources to help potential applicants prepare for the Competitive Digital Equity Act NOFO release later in July:

- Competitive Grant Program Get Ready One Pager.

- It is also recommended using the Digital Equity Act Population Viewer to understand how many people are in each Covered Population in the area an applicant would serve

- Pots and Pans Publication in their June 5 edition discussed several policy items that were inserted into the congressional bill that reauthorizes funding the NTIA:

- Both House and Senate added language that would require that a national broadband plan be created that would try to put the FCC, the NTIA, USDA, and other agencies on the same page. The author stressed that it is clear that the 3 agencies do not coordinate in trying to solve the broadband gap.

- The biggest flaw in the BEAD maps is the decision of the FCC to still allow ISPs to claim marketing speeds rather than actual speeds. They suggest this FCC reporting requirement should be changed.

- The article suggests that FCC thought they had accounted for the map problem by allowing for a map challenge process, without realizing that the counties that have the biggest broadband gaps are the ones with no staff or budget, so the places that should have undertaken map challenges are doing nothing. PLUS, the map challenge process for BEAD is so technical even well-funded counties cannot come close to putting up a decent challenge.

- Some legislators are accusing NTIA of violating rate regulation rules of the Infrastructure Act.

- BEAD regulations require providers to set up affordable plans for low-income households to get connected on BEAD funded infrastructure.

- NTIA specifically is asking for a price point or formula that will be used to calculate the low- cost plan.

- Legislators say this is illegal and NTIA is stating they are not setting rates.

- A few states plan required providers to submit their own low-cost plans as part of the application process with no requirement of a state wide requirement but NTIA has pushed back and asked the states to set up more concrete requirements around this provision

- There have not been many state plans approved by NTIA and those that have been approved have a specific price point.

- NTIA Internet Use Study (November 2023)

- Compared internet users from 2021 to 2023.

- Showed 13 million more internet users in the US between the time frames.

- 83% of people ages 3 and older in US used the Internet in some fashion in 2023, compared with 80% in 2021.

- These gains came in large part from segments of the population that historically have been unserved. 83% of American Indians and Alaska Natives used the Internet in 2023, up from 75 %in 2021.

- Internet adoption increased in lower-income households, from 69% in 2021 to 73 % in 2023 among households making less than $25,000 per year.

- 72% of people lived in households with both fixed and mobile Internet connections in 2023, up from 69% in 2021.

- Just 12% of people lived in households without any internet connection in 2023, compared with 14% in 2021.

- 80% of people making $100,000 or more per year had both fixed and mobile connections.

- Only 54% of those making less than $25000 per year had both.

- 25% of Hispanics are smartphone users only.

- 22% American Indians and Alaska natives are smartphone users only.

- 16% of black Americans are smartphone users only. Of white non-Hispanics and Asians are smartphone users only.

- The full survey is available on the NTIA website.

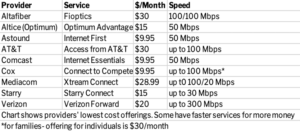

- The ACP has officially ended. There is nothing on the horizon federally, in the near future, to replace this program. At this time, it is up to the individual states and the providers to address affordability, the number 1 reason for not subscribing to broadband. An article in Telecompetitor identified 14 providers who were offering ACP replacement programs offering plans at $30 or less to low-income households through 2024:

- There are other providers across the nation providing low-cost plans. Of note, some of the plans do not meet the definition of broadband at 100 Mbps download and 20 Mbps upload.

- Letter of Credit

- On June 6 the FCC Commissioners unanimously adopted revisions that eased the Letter of Credit requirements for the RDOF program. The FCC also indicated it is looking at extending these eased LOC requirements to the CAF II program.

- Defaults of Providers on Previous Awards

- A petition was submitted to the FCC asking them to offer an amnesty period to encourage providers that wish to default to do so sooner rather than later to free up those locations for the BEAD program.

- The reasoning for the petition was due to the fact that locations awarded under previous programs are ineligible for the BEAD funds. Should providers default on these awards after BEAD locations are finalized, that could leave locations in the hardest-to-reach areas of the country without access to federal broadband funding.

- The FCC concluded that there is no need for “broad relief” from penalties for broadband providers that default on awarded locations through RDOF and CAF II, citing its existing procedures and concerns about program integrity.

- FCC further said it will continue to waive certain penalties on a case-by-case basis and urge individual providers to contact the Bureau as well as their state Office of Broadband to discuss their specific situation.

- FCC has guidance available for RDOF and CAF II support recipients on procedures for provider defaults to ensure that broadband networks are deployed to all consumers. You may read the guidance on the fcc.gov website, Public Notice dated July 3, 2024, DA 24-646.

- AU Docket No. 20-34

- AU Docket No. 17-183

- WC Docket No. 19-126

- WC Docket No. 10-90

- This guidance is long and detailed. It is encouraged that all providers become familiar with the guidelines.

May 2024

No updates.

- Net Neutrality Order

- Reinstates nearly the same Title II rules back that were vacated by the Title II authority (previous administration).

- Refers to broadband as BIAS (broadband internet access service and ISPs are3 called BIAS providers.

- Broadband is considered to be a telecommunications service, not an information service.

- FCC granted itself new and expanded authority to defend national security. FCC added addressing cyber security issues to its role.

- Gives more tools to deal with network resiliency and reliability related to natural disasters. Gives FCC authority to make ISPs participate in the Mandatory Disaster Response Initiative.

- Reinstate3s privacy and data security rules under Section 222 rules have only been applied to voice services.

- Gives FCC authority to develop rules that apply to ISPs that serve multi-dwelling units.